Norwich Connecticut Property Taxes

The local property tax is computed and issued by your local tax collector.

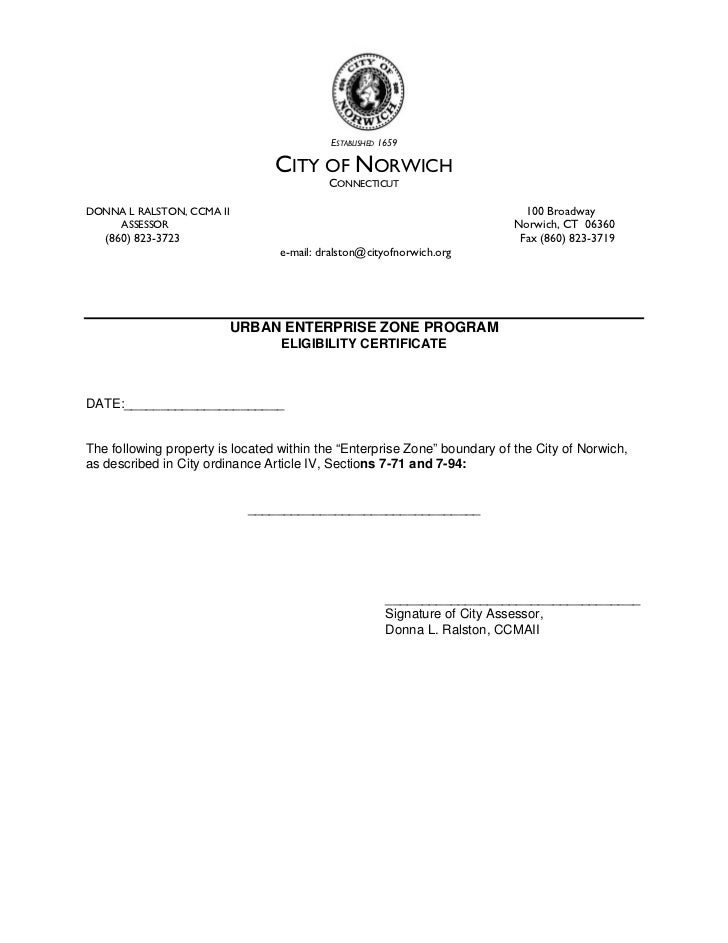

Norwich connecticut property taxes. Your tax collector will need to clear you online. This data base contains assessments for each real property in the city of norwich. One mill is equal to one dollar of tax per 1 000 of assessed property value. In connecticut municipalities assess property at 70 percent of its fair market value according to the office of legislative research.

Property is revalued at least once every five years. If you do not register a motor vehicle but retain ownership you must annually file a declaration form with your assessor s between october 1 and november 1. They issue yearly tax bills to all property owners in city of norwich and work with the sheriff s office to foreclose on properties with delinquent taxes. Details are available from the assessor.

Welcome to norwich ct assessors online database. Real estate taxes are the primary revenue source for connecticut s towns and cities. Taxes can be paid directly from that website. Address owner acct mblu pid all search enter an address owner name mblu acct or pid to search for a property.

The city of norwich tax collector is responsible for collecting property tax from property owners. Taxes can be paid directly from that website. Dmv will no longer accept paper tax releases beginning november 16 2015. Norwich property tax information is available by clicking on tax bill inquiry.